Welcome again! Starbucks’ limited-edition crimson, chrome steel “quencher” has the kind of valuation surge most startups would die for. The 40-ounce tumbler, made with Stanley and retailing for $49.95, is being resold for as much as $300 online.

In as we speak’s huge story, we’re why the market could be on the cusp of a once-in-a-generation investing moment (however not with the names you are aware of).

What’s on deck:

However first, I took the one much less traveled by.

The large story

Beneath the radar

In terms of the inventory market, the actual worth is within the crumbs.

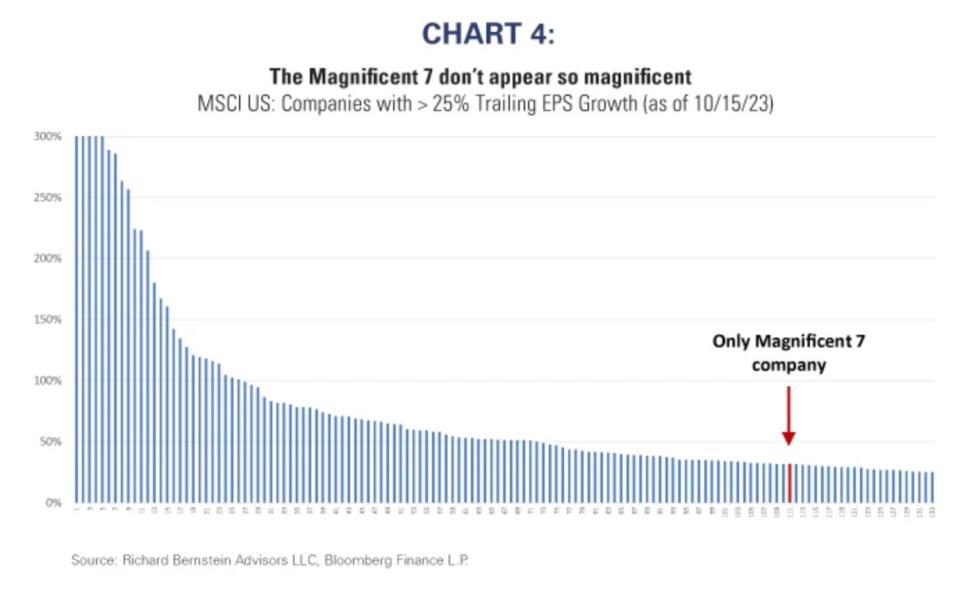

As a substitute of worrying in regards to the standing of the much-ballyhooed Magnificent Seven shares, buyers ought to be focusing on under-the-radar stocks, in response to funding chief Richard Bernstein.

The previous chief funding strategist at Merrill Lynch views the prospect to get in on less-glamorous shares as a “once-in-a-generation” opportunity.

Bernstein’s thesis for wanting outdoors the Magnificent Seven is pretty simple: the variety of shares notching huge features is about to broaden, giving unloved shares a resurgence.

“Are these seven actually the very best progress tales in all the international fairness market?” he informed Insider’s Jennifer Sor.

The info backs Bernstein. Over 100 US corporations noticed at the least 25% earnings progress prior to now 12 months, however just one (Amazon) was a Magnificent Seven.

Outdoors-the-box considering could be buyers’ greatest guess lately.

A word from Financial institution of America pointed to its Promote Aspect Indicator, which flashes bullish alerts when Wall Road turns into overly bearish.

The contrarian sentiment gauge is presently impartial, but it surely’s three times closer to a “buy” signal than a “sell” one. At its present stage, it is suggesting a couple of 15.5% achieve within the S&P 500 over the subsequent 12 months.

Such sturdy stances come at a novel time for the market, as many investors are waffling over the place issues are headed.

Any positives for the market — strong earnings, GDP growth, pause on rate hikes — have been coupled with negatives — troubling year-end forecasts, rising bond yields, increasing geopolitical risks — over the previous few months.

Having conviction and staying away from fashionable shares could be buyers’ greatest guess.

In fact, it will not occur in a single day. Bernstein informed Jennifer to not anticipate an identical market rally within the wake of the pandemic. A extra correct comparability, he mentioned, can be when S&P 500 leaders misplaced worth within the 2000s whereas underdogs carried out.

Information temporary

Your Monday headline catchup

A fast recap of the highest information from over the weekend:

3 issues in markets

-

What final week’s “child rally” means for the market going ahead. Fundstrat’s Tom Lee sees basic and technical causes for the market to keep the momentum going. A robust earnings season and Wall Road’s worry gauge plummeting are all good indicators.

-

Charlie Munger sounds off. Warren Buffett’s right-hand man talked about the whole lot from bitcoin to the woes of inventory choosing throughout a current interview. Munger, who’s value almost $3 billion, mentioned there is a 50/50 likelihood Berkshire Hathaway will make one other huge acquisition. Check out eight of his best quotes.

-

The top of the AI market boon. Veteran investor Invoice Smead says the AI craze is overblown and sees a painful comedown for stocks. “AI seems like tech inventory and S&P 500 index life help to us,” Smead mentioned.

3 issues in tech

-

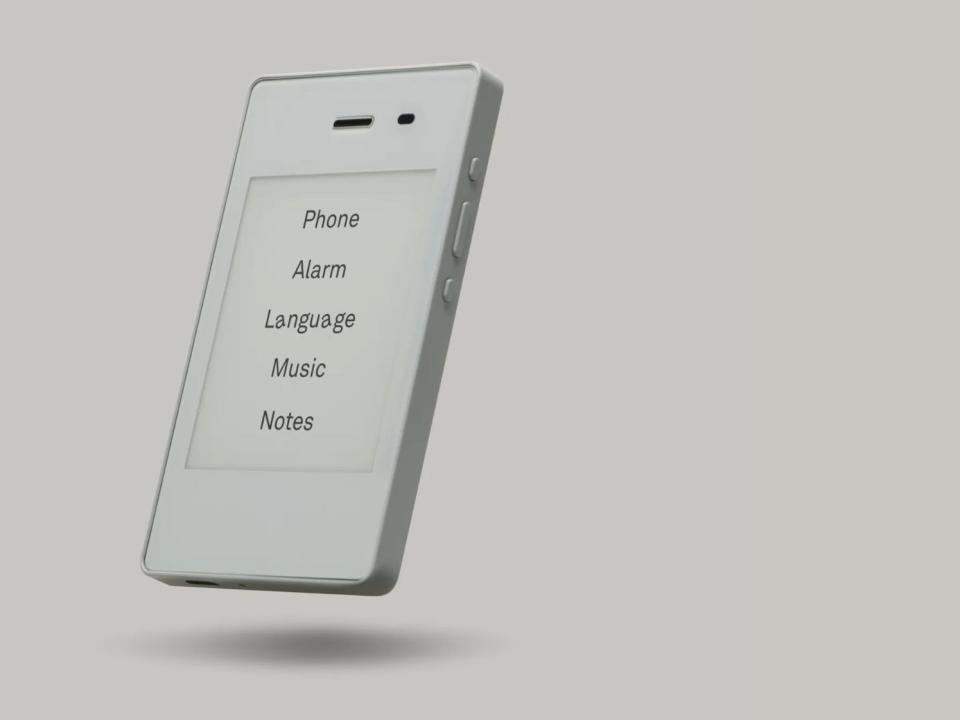

Good child, ‘dumb’ cellphone. Rapper Kendrick Lamar’s artistic company’s new, no-frills phone has already sold out. Mild Cellphone 2, which is priced at $299, presents a minimalistic expertise with out apps or colour.

-

All the very best bits from Elon Musk’s chat with the British prime minister. The billionaire was interviewed by Rishi Sunak following his look on the AI Security Summit. Musk touched on the way forward for jobs and authorities regulation. These are the best quotes.

-

Linda Yaccarino places her foot down. The CEO of X reportedly stepped in to remove a viral pro-Hitler post on the platform. The transfer comes regardless of X proprietor Elon Musk being an unapologetic proponent of free speech.

3 issues in enterprise

-

Gen Z is all about that cash. Having watched older generations battle with private funds, Gen Zers are proving to be financially savvy. In accordance with one survey, most Gen Zers are already saving for retirement.

-

The Ozempic impression on the financial system. The knock-on results of weight-loss medication are almost innumerable. One of many huge winners, in response to an knowledgeable, is “better-for-you merchandise” as folks focus extra on life-style and health.

-

How corporations determine who’s on the chopping block. An knowledgeable in serving to corporations talk layoffs presents an inside look at the process. One factor to recollect: it is extra typically associated to tightening margins versus precise efficiency.

In different information

What’s occurring as we speak

-

Trump takes the stand. Former President Donald Trump is predicted to testify within the civil fraud trial in opposition to the Trump Group.

-

OpenAI opens its doorways. The buzzy AI startup hosts its inaugural developer convention, OpenAI DevDay.

-

Completely satisfied Saxophone Day! The vacation corresponds with the birthday of the instrument’s inventor, Adolphe Sax.

To your bookmarks

Martha is aware of greatest

Martha Stewart informed Insider the 5 recipes everybody ought to learn to make. From a few tasty pies to a easy salad French dressing, check them all out here.

The Insider As we speak group: Dan DeFrancesco, senior editor and anchor, in New York Metropolis. Diamond Naga Siu, senior reporter, in San Diego. Hallam Bullock, editor, in London. Lisa Ryan, government editor, in New York.

Learn the unique article on Business Insider