-

A “child rally” has unfolded within the inventory market that may very well be the beginning of a broader year-end rally.

-

That is based on Fundstrat’s Tom Lee, who highlighted elementary and technical causes for a rally.

-

“There are just a few structural causes to count on shares to have some constructive traction in coming weeks,” Lee stated.

A “child rally” has taken maintain of the inventory market in current days, and it might characterize the beginning of a bigger year-end surge in inventory costs.

That is based on a Friday observe from Fundstrat’s Tom Lee, who highlighted a number of elementary and technical elements that ought to help inventory costs over the subsequent few weeks.

“Incoming macro developments have been favorable in a approach that, in our view, units the stage for shares to achieve within the near-term,” Lee stated. “Up to now, it’s a ‘child rally’ however this might flip into a bigger rally.”

For one, Lee stated {that a} delicate October jobs report “could be unequivocally constructive” for inventory costs. That is exactly what happened, with 150,000 jobs added to the economic system final month, under consensus estimates for a acquire of 180,000 jobs.

That softness within the jobs report offers the Federal Reserve extra respiratory room in its trajectory path of rates of interest. The 10-year US Treasury yield fell 15 basis points to 4.50% on Friday after hitting a multi-year excessive of greater than 5% final week.

In the meantime, company earnings outcomes for the third-quarter have remained overwhelmingly constructive. Up to now, 80% of S&P 500 firms have reported earnings, and 82% of these firms beat earnings by a median of seven%, based on knowledge from Fundstrat.

Different constructive fundamentals growing in markets, based on Lee, contains the inventory market worry gauge (the VIX) plunging from the 20 stage to simply above 15, the top of tax loss harvesting trades for mutual funds in October, and a significant transfer decrease in long-term rates of interest.

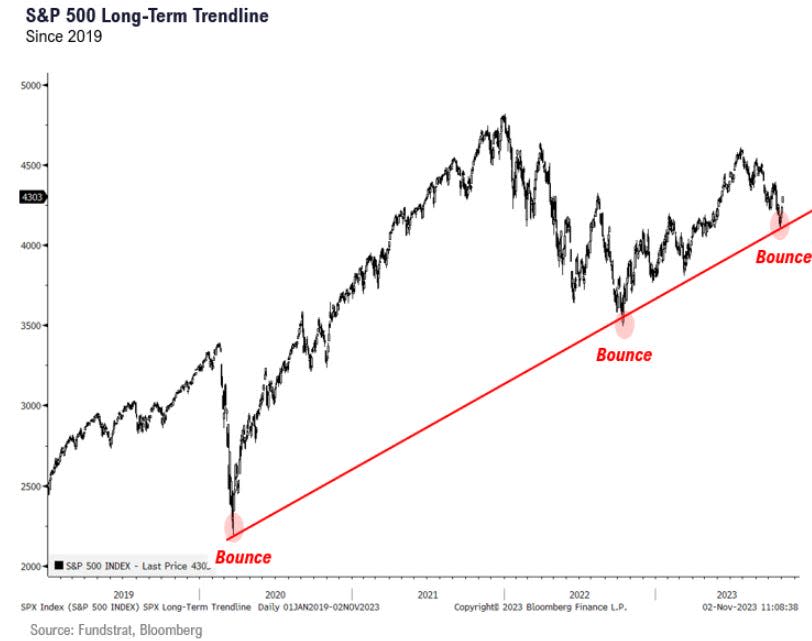

From a technical perspective, Lee stated “there are just a few structural causes to have some constructive traction in coming weeks.”

These causes embrace the proportion of shares buying and selling above their 200-day shifting common falling to simply 23%, which is a backside decile studying since 1994. When shares have gotten this oversold, the median six-month ahead acquire is 9.7% with a 80% win-ratio, based on Lee.

In the meantime, the Nasdaq 100 noticed 15 consecutive days when the 5-day return was unfavorable. This has occurred solely 14 instances since 1985, and excluding the dot-com bubble, the median 12-month ahead acquire was 19% with a 91% win-ratio.

“These are significant quantitative/structural arguments for why a durable bottom was formed in late October. And if that’s the case, this can be a case for this ‘child rally’ to strengthen,” Lee stated.

Learn the unique article on Business Insider