A residential complicated constructed by Evergrande in Huai’an, Jiangsu, China, on July 20, 2023.

Future Publishing | Future Publishing | Getty Photos

BEIJING — China’s housing ministry has introduced plans to make it simpler for folks to purchase property.

The information, out late Thursday, signifies how totally different ranges of presidency are beginning to act simply days after Beijing signaled a shift away from its crackdown on actual property hypothesis.

associated investing information

The deliberate measures embrace easing buy restrictions for folks wanting to purchase a second home, and lowering down fee ratios for first-time homebuyers, in keeping with an article on the Ministry of Housing and City-Rural Growth’s web site.

In an effort to scale back hypothesis in its huge property market, China has made it a lot tougher for folks to purchase a second home.

Mortgage charges for the second buy generally is a full share level greater than for the primary, whereas the second-home down fee ratio can skyrocket to 70% or 80% in massive cities, in keeping with Natixis.

The housing ministry article referred to feedback from its minister Ni Hong at a latest assembly with eight state-owned and non-state-owned firms in building and actual property.

Because it was a gathering on the central authorities ministry degree, it didn’t focus on insurance policies for particular person cities, mentioned Bruce Pang, chief economist and head of analysis for Better China at JLL.

However he expects Beijing will encourage native governments to announce actual property coverage modifications that match their particular scenario. Pang additionally identified that together with building firms on the assembly emphasised their position in selling funding and stabilizing progress.

Ready on particulars

China has not but introduced formal measures for supporting actual property. Nonetheless, prime degree leaders on Monday signaled a higher deal with housing demand, fairly than provide.

On Tuesday, China’s State Taxation Administration announced “guidelines” for waiving or lowering housing-related taxes. It was not instantly clear what implementation would appear to be for house consumers.

We proceed to count on the property sector rally to proceed and advise buyers to deal with beta names throughout the property sector.

The readout of Monday’s Politburo assembly additionally eliminated the phrase “homes are for residing in, not hypothesis,” which has been a mantra for Beijing’s tight stance and efforts to rein in builders’ excessive reliance on debt for progress.

“It appears to us that [the housing ministry] is fast in response this time and in addition will get bolder on stress-free property insurance policies,” Jizhou Dong, China property analysis analyst at Nomura, mentioned in a notice Friday.

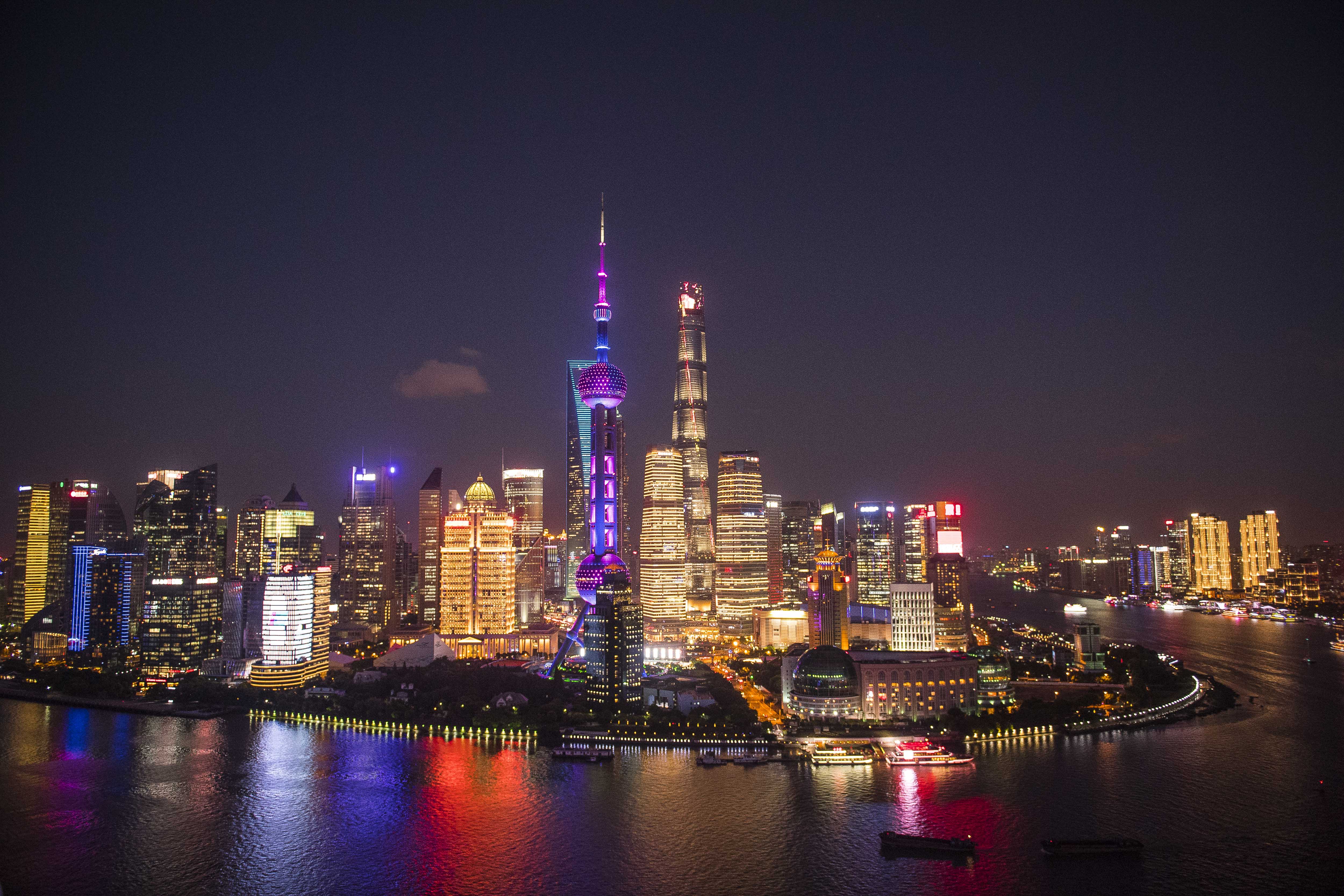

Given such pace, Dong expects markets are anticipating particular coverage implementation in cities corresponding to Shanghai or Guangzhou.

Hong Kong-traded Chinese language property shares corresponding to Longfor, Nation Backyard and Greentown China traded greater Friday, on tempo to shut out the week with positive factors after plunging on Monday over debt worries.

“We proceed to count on the property sector rally to proceed and advise buyers to deal with beta names throughout the property sector,” Nomura’s Dong mentioned.

These shares embrace U.S.-listed Ke Holdings, in addition to Hong Kong-listed Longfor and China Abroad Land and Funding, the report mentioned, noting Nomura has a “purchase” ranking on all three.

“We nonetheless advise buyers to keep away from weaker privately-owned builders.”