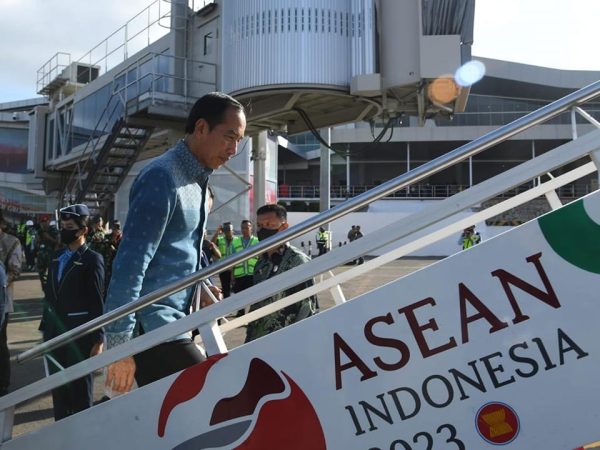

It ought to come as no shock that the Affiliation of Southeast Asian Nations (ASEAN) summit hosted by Indonesia final week was branded with the slogan “Epicenter of growth.” President Joko “Jokowi” Widodo is thought for his give attention to infrastructure and dwelling requirements, and he sees ASEAN primarily as a discussion board for commerce and funding.

This economics-focused strategy has confirmed well-liked at residence, profitable Jokowi reelection in 2019, whereas his high popularity ratings at this time mirror Indonesia’s continued sturdy development within the face of a world recession. Certainly, with many of the world tormented by stagflation, Yokowism has change into a spotlight of financial commentary.

Even a cursory look at its observe file since 2014 reveals a realistic however populist financial coverage that favors state steering over privatization and liberalization.

The prominence of Indonesian state-owned enterprises (SOEs) illustrates this strategy. They’ve constantly served because the driving pressure behind infrastructure improvement and different social welfare initiatives – and by design.

As worldwide economist Kyunghoon Kim argued a recent newspaper, Jokowi and his SOE minister Erick Thohir intentionally shifted the main target of state-owned enterprises from revenue era to home improvement in sectors equivalent to banking, mining and development. Thohir was picked for the ministry in 2019 after main Jokowi’s profitable re-election marketing campaign, and Kim notes how he has used his non-public sector experience to make sure international funding is in keeping with the nationwide curiosity.

Placing Indonesia first can also be central to Jokowi’s downstream policya post-2018 innovation by which the nation’s appreciable pure sources are processed into merchandise domestically quite than being exported overseas as a uncooked materials.

For instance, the government-owned Indonesia Battery Cooperation combines mining, smelting, and manufacturing capabilities, provides high-quality completed merchandise to worldwide markets, and provides Indonesian nickel to a handful of distributors. This has helped the nation get a foothold within the profitable and fast-growing electrical car (EV) market, and its advantages are being utilized to different industries from vitality to shopper items.

And whereas “useful resource nationalism” might run counter to Western neoliberal consensus, Indonesia’s mineral wealth offers it the ability to dictate circumstances in favor of presidency revenues and for newly skilled employees within the type of increased wages.

Yokowism is due to this fact intentionally populist however pragmatic and even dedicated free merchants have admitted its success.

However with elections looming in February 2024 and the Indonesian chief nearing the tip of his two-term restrict, there are questions on how lengthy the established order will stay. Provided that Jokowi stays – and will proceed to be – the nation’s hottest politician for a while to return – his successor will possible wish to take over his financial legacy.

The presidential candidate of the ruling PDI-P celebration, Ganjar Pranowo, and Protection Minister Prabowo Subianto (who can also be chairman of the Gerindra celebration) are the two leaders changing Jokowi. Neither has signaled a change in strategy to the Indonesian financial system.

Moderately, each males have benefited from their shut affiliation with the president, Ganjar as a fellow PDI-P man and Prabowo as an enemy turned pal, having misplaced to Jokowi in 2014 and 2019, however loyal in his cupboard ever since serve.

If Ganjar and Prabowo are neck-and-neck within the race to win Jokowi’s endorsement, then their selection of operating mates might show essential.

By way of their dedication to the president’s financial philosophy, Financial system Minister Airlangga Hartarto is thought it was a smart VP choiceas is the aforementioned SOE boss, Erick Thohir.

Hartarto, as chairman of the Golkar celebration, is sort of properly positioned in Prabowo’s “Grand Alliance”, whereas Thohir ranks strongly as a operating mate for each Prabowo and Ganjar.

Speaker of the Indonesian Home of Representatives Puan Maharani has also been praised for the Ganjar ticket. Her legislative data and political capital – Puan is the eldest daughter of PDI-P chief Megawati Sukarnoputri – would definitely be of worth in operating the financial system.

Tickets are clearly nonetheless in flux, and operating mates most likely will not be chosen till October. That mentioned, there may be little doubt that financial points equivalent to shopper costs and employment will dominate the 2024 Indonesian election.

No candidate will utterly break with the insurance policies of the previous 9 years below Jokowi – the political and financial danger is just too nice. As a substitute, they may actually be targeted on constructing a staff that may tackle the mantle of Jokowism in his absence.

And since Indonesians will not settle for a similar for lengthy, any viable ticket will need to have the concepts and expertise to maneuver the nation ahead — and to take action in an period of even higher financial and geopolitical turmoil than throughout Jokowi’s tenure. .