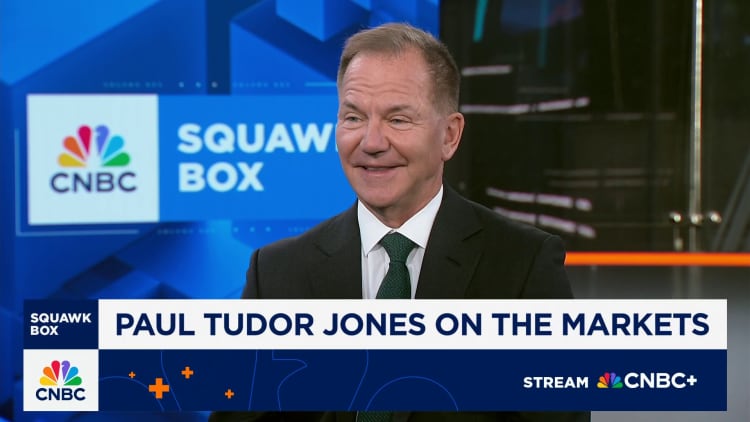

Billionaire hedge fund supervisor Paul Tudor Jones believes the circumstances are set for a robust surge in inventory costs earlier than the bull market tops out.

“My guess is that I feel all of the elements are in place for some form of a blow off,” Jones stated on CNBC’s “Squawk Field” Monday. “Historical past rhymes loads, so I’d assume some model of it’s going to occur once more. If something, now’s a lot extra doubtlessly explosive than 1999.”

The founder and chief funding officer of Tudor Funding stated right this moment’s market is harking back to the setup main as much as the burst of the dotcom bubble in late 1999, with dramatic rallies in know-how shares and heightened speculative conduct. Jones stated the round offers or vendor financing taking place within the synthetic intelligence house right this moment additionally made him “nervous.”

The tech-heavy Nasdaq Composite has bounced 55% from its April backside to consecutive report highs. The rally has been pushed by mega-cap tech giants, which have invested billions in AI and are being valued richly on the potential of this rising period.

Nasdaq Composite yr so far

The distinction between now and 1999 is the U.S. fiscal and financial coverage, Jones famous. The Federal Reserve had simply begun a brand new easing cycle, whereas charge hikes have been on the way in which earlier than the market prime in 2000. The U.S. is now working a 6% finances deficit, whereas in 1999, there was a finances surplus in $99,000, Jones stated.

“That fiscal financial mixture is a brew that we’ve not seen since, I suppose, the postwar interval, early 50s,” he stated.

The longtime investor highlighted the stress on the coronary heart of each late-stage bull market — the desperate to seize outsized good points and the inevitability of a painful correction.

“You must get on and off the practice fairly fast. In case you simply take into consideration bull markets, the best worth appreciations at all times [occurs] the 12 months previous the highest,” Jones stated. “It form of doubles regardless of the annual averages, and earlier than then, in the event you do not play it, you are lacking out on the juice; in the event you do play it, it’s important to have actually joyful ft, as a result of there will probably be a extremely, actually unhealthy finish to it.”

To make sure, Jones is not predicting a right away downturn. He believes the bull market nonetheless has room to run earlier than it reaches its ultimate part.

“It is going to take a speculative frenzy for us to raise these costs. It is going to take extra retail shopping for. It’s going to take extra recruitment from quite a lot of others from lengthy quick hedge funds, from actual cash, and so forth.,” he stated.

He stated he would personal a mixture of gold, cryptocurrencies and Nasdaq tech shares between now and the top of the yr to make the most of the rally fueled by the worry of lacking out.

Jones shot to fame after he predicted and profited from the 1987 inventory market crash. He’s additionally the co-founder of nonprofit Simply Capital, which ranks public U.S. corporations primarily based on social and environmental metrics.

Correction: The tech-heavy Nasdaq Composite has bounced 55% from its April backside to consecutive report highs. A earlier model misstated the share.