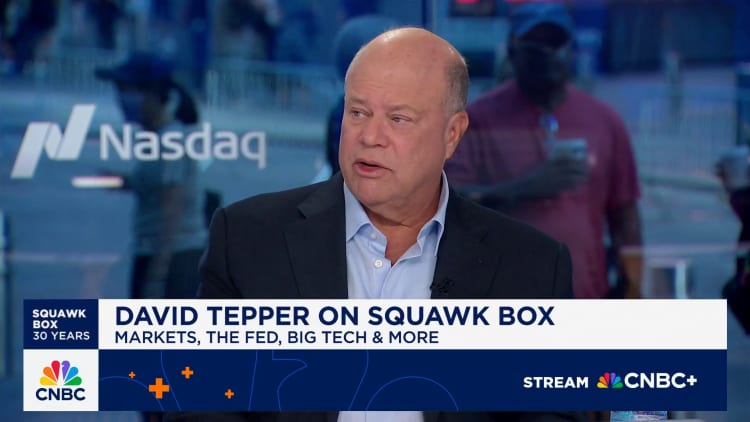

Hedge fund billionaire David Tepper stated the Federal Reserve may reduce charges a bit extra, however then dangers extra inflation and different risks to the economic system and markets if the central financial institution goes additional than that.

In different phrases, watch out what you would like for.

“In the event that they go an excessive amount of extra on rates of interest, relying what occurs with the economic system … it will get into the hazard territory,” Tepper stated Thursday on CNBC’s “Squawk Field.” “You have to watch out to not make issues too sizzling.”

His feedback come after the central financial institution lowered rates of interest by 1 / 4 level Wednesday, the primary reduce this 12 months, whereas signaling two extra reductions are coming this 12 months. Fed Chair Jerome Powell characterised the reduce as “threat administration” somewhat than one thing extra directed at shoring up a weak economic system. President Donald Trump has been pressuring the chief to slash the fed funds charge shortly and aggressively.

Tepper feared that if the Fed lowers charges whereas inflation hasn’t been totally tamed, demand can choose up sooner than provide, reigniting worth pressures. In the meantime, too-easy financial coverage may probably create asset bubbles as traders preserve flocking into riskier corners of the markets.

“My view has been that one easing or two easings and even three easings do not matter as a result of we’re nonetheless in slightly restrictive territory with slightly bit too excessive inflation, even with out the tariff-induced inflation. So they need to be slightly bit restrictive,” Tepper stated. “Past that, you are actually risking a number of issues, a weaker greenback, extra inflation and people type of issues.”

‘Do not battle the Fed’

The founder and president of Appaloosa Administration famous valuations are excessive, however he would not wager in opposition to shares but whereas the Fed remains to be in easing mode.

“I do not love the multiples, however how do I not personal it?” Tepper stated. “I am not ever combating this Fed particularly when the markets inform me … one and three quarter extra cuts earlier than the top of the 12 months, in order that’s a tricky factor to not personal.”

The S&P 500 is buying and selling at nearly 23 occasions ahead earnings, close to the very best stage since April 2021, in accordance with FactSet. Valuations for a few of the megacap tech names have change into sky excessive. Nvidia‘s price-earnings ratio is at 30 occasions, whereas Microsoft trades at practically 32 occasions ahead earnings.

“I am constructive due to the easing proper now, however I am additionally depressing due to the degrees,” he stated. “Nothing’s low cost anymore.”

Tepper, additionally the proprietor of NFL group the Carolina Panthers, revealed he is been buying and selling his Nvidia place. On the finish of June, Appaloosa held about $277 million value of the chip inventory, proudly owning it because the fund’s seventh-biggest wager.

“I do personal Nvidia, however I commute slightly bit … commerce slightly bit,” Tepper stated. “We have all the time had some Nvidia place, however not the identical dimension.”

Click on right here to observe the total interview.