-

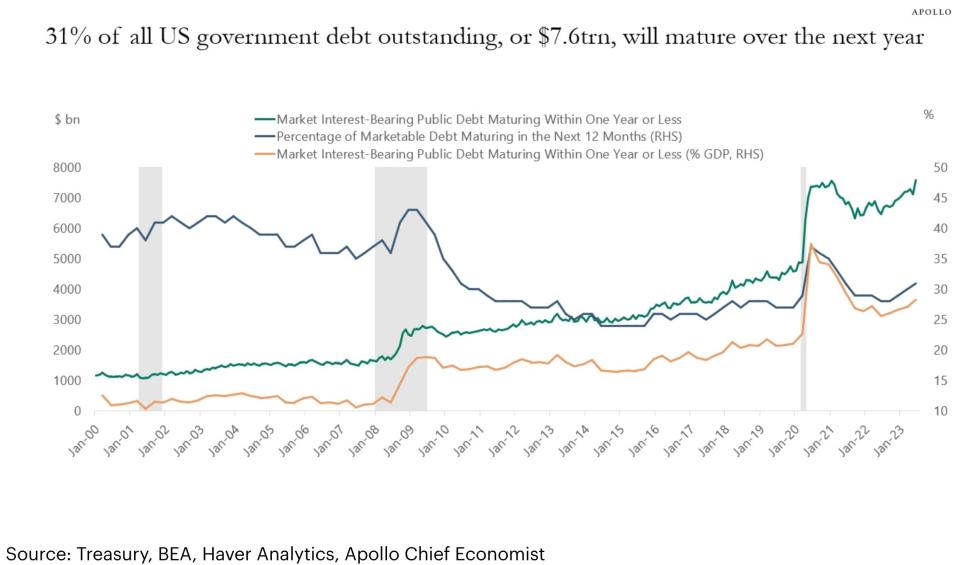

A whopping $7.6 trillion in interest-bearing US public debt will mature inside a 12 months, Apollo’s chief economist stated in September.

-

That represents 31% of all excellent US authorities debt, including upward stress on charges.

-

That is nonetheless under 2020, when debt maturing inside a 12 months made up a considerably bigger share.

Practically a 3rd of all excellent US authorities debt is about to mature within the subsequent 12 months, in keeping with an evaluation from asset management firm Apollo.

A chart shared by Chief Economist Torsten Sløk in September confirmed that the share of US public debt set to mature in a 12 months or much less has steadily risen towards pandemic-era ranges and is now at 31%.

When it comes to greenback quantity, that is $7.6 trillion, a excessive not seen since early 2021, and is a supply of upward stress on US charges, he added.

As well as, public debt maturing within the close to time period accounts for greater than 1 / 4 of US GDP. Nevertheless, that is under its 2020 peak, when it made up a considerably bigger share.

The estimate comes as federal deficits have exploded in recent times, sharply elevating the trajectory of US debt. The Treasury Division auctioned $1 trillion in bonds simply inside the third quarter.

The US debt coming due subsequent 12 months might maintain rising, after the Treasury issued its newest quarterly refunding assertion in early November. Towards expectations, the division elected to lean extra on T-bills issuance transferring ahead, and sluggish the sale of longer-dated bonds.

In the meantime, borrowing prices have soared within the final 12 months and a half because the Federal Reserve launched into an aggressive tightening marketing campaign, elevating the federal government’s debt-servicing prices. Regardless of coming down sharply in November, they continue to be effectively above year-ago ranges.

Charges have additionally been underneath stress from the Fed’s quantitative tightening program, which eliminated a high purchaser from the bond market. The central financial institution has allowed about $1 trillion of its debt holdings to run off its balance sheet.

The Treasury has hit some snags looking for sufficient patrons for the surge of recent debt. Current auctions have been met with weak demand whereas others noticed regular uptake.

Learn the unique article on Business Insider