Apple (NASDAQ:AAPL) inventory has been actually struggling to interrupt by to a brand new all-time excessive. Undoubtedly, Apple appears to have been outshined by its friends within the Magnificent Seven, however there exist catalysts that might assist energy a much-awaited rally, maybe to the Avenue-high worth goal of $250 per share.

Certainly, Apple inventory appears to be fairly the battleground between the bulls and the bears, particularly currently. The bears would level to weak development and stagnation in iPhone demand within the Chinese language market. In the meantime, the bulls have a powerful argument that the high-margin Providers section continues to swell and that looming merchandise might simply drive development charges a lot increased.

Personally, I’m siding with the bull camp. Although bearish arguments are fairly sound, I do imagine they’re too backward-looking. Certain, the iPhone 15 Professional Max might have had a lot better gross sales had the Chinese language economic system not been in a large hunch. And the current drama revolving round Apple Watches being pulled from cabinets has taken a refined jab to the wearables section.

Apple Imaginative and prescient Professional Can be a Larger Deal within the Future

Although the recent quarter wasn’t unhealthy, it actually left a lot to be desired. Nonetheless, with the Imaginative and prescient Professional promoting fairly fairly effectively, search for the brand new spatial computing machine to grow to be a much bigger a part of the Apple revenue pie every yr.

Although the Imaginative and prescient Professional in all probability received’t surpass iPhone gross sales within the subsequent three to 5 years, I believe it might give the Mac section a superb run for its cash. That is very true if Apple’s innovators can cut back the scale and energy necessities of the machine (a smaller type issue with no indifferent battery will surely assist the machine grow to be greater than only a “area of interest product”).

Although it’ll take time for gross sales in Imaginative and prescient Professional to march increased, I imagine that developments on the software program aspect might act as a driver on the share worth within the near-to-medium time period. We’re possible greater than a yr away from the subsequent iteration of Apple’s spatial pc. Nonetheless, 2024 might see some important software program enhancements (particularly relating to AI) till then.

Whether or not we’re speaking about extra refined updates to visionOS (the Imaginative and prescient Professional’s working system) or a rising variety of apps (maybe a few of them can be so-called “killer” apps?), the keenness surrounding the product has the potential to develop at an exponential fee from right here.

Within the meantime, I believe the Imaginative and prescient Professional’s App Retailer (there have been 600 apps on day one of many launch) library is wanting fairly strong. As extra builders get their fingers on the visionOS instruments, I’d search for the variety of apps and video games to surge into yr’s finish. That alone might make the Imaginative and prescient Professional a large driver of the inventory as traders anticipate larger gross sales sooner or later in response to the quickly advancing software program ecosystem.

WWDC 2024 Could also be That A lot-Awaited AI Reveal

Following the discharge of Apple’s newest outcomes, CEO Tim Cook dinner teased analysts, hinting that generative AI merchandise can be coming later within the yr. It’s no thriller that Apple has been investing “large effort and time” (as per Tim Cook dinner) into AI integration. And although it could have been good to have some extra specifics from Cook dinner, like a selected date and options, I imagine the AI premium that many Magnificent Seven shares now command can be commanded by Apple as soon as its new AI improvements are lastly unveiled.

Mark Gurman of Bloomberg thinks iOS 18 (the subsequent replace to iPhone’s working system that may very well be a spotlight of this yr’s WWDC) might signify the “greatest” replace in its historical past, thanks partially to AI. We will solely speculate at this level, however I believe he’s proper on the cash. Extra particulars on the replace might very effectively assist drive the inventory above $200, maybe towards the $250 Avenue-high goal at present held by Wedbush analyst Daniel Ives.

Ives sees the Imaginative and prescient Professional as Apple’s “first main push” into the realm of AI. If he’s proper, different analysts on Wall Avenue might discover themselves racing to improve their targets to costs extra in line (or perhaps exceeding) that of Ives’.

Undoubtedly, ChatGPT-like Siri Updates and a possible AI App Retailer might propel Apple inventory from an AI underdog to one of many prime contenders, maybe even a pacesetter. That is particularly possible given {that a} overwhelming majority of Apple’s “golden” put in base will actively use such applied sciences if they’re featured as a part of iOS 18.

Is AAPL Inventory a Purchase, In keeping with Analysts?

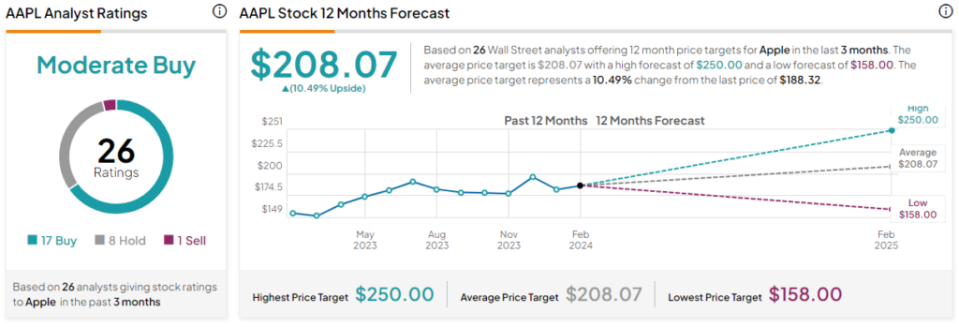

On TipRanks, AAPL inventory is available in as a Average Purchase. Out of 26 analyst rankings, there are 17 Buys, eight Holds, and one Promote advice. The average AAPL stock price target is $208.07, implying upside potential of 10.5%. Analyst worth targets vary from a low of $158.00 per share to a excessive of $250.00 per share.

The Backside Line

It’s straightforward to be less-than-upbeat on Apple inventory because the iPhone maker’s gross sales development and shares stall. That stated, for those who look to Apple’s close to future, it’s clear that promoting AAPL inventory proper right here might show to be a mistake, particularly if Ives’ predictions come true.

For now, I’d look to WWDC 2024 and Imaginative and prescient Professional information as potential catalysts to assist drive shares increased on the yr. May 2024 be Apple’s yr of AI? I believe it may very well be.