Even in case you’re not an investor that commonly swings for the fences, you have seemingly dreamed of hitting a proverbial grand slam that will get your portfolio over the seven-figure hump.

The factor is, such trades aren’t as unusual as you may assume. You simply have to seek out the suitable firm in the suitable enterprise on the proper second. Time will deal with the remainder.

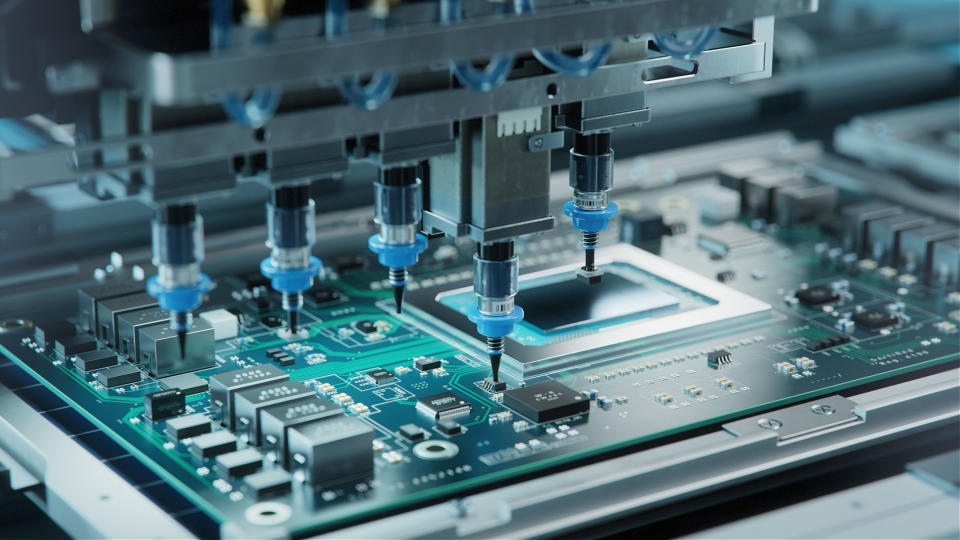

On that notice, there’s one explicit expertise inventory that is not solely already turned many affected person buyers into millionaires, however can proceed doing so sooner or later. That is Nvidia (NASDAQ: NVDA). This is a better have a look at why it has been such a winner to date, and why it is poised to proceed minting millionaires going ahead.

Nvidia, up shut and private

You’ve got in all probability already acquainted with the corporate, however Nvidia hasn’t all the time been the titan it’s at the moment. It has, nonetheless, all the time been a profitable cutting-edge technology participant.

The corporate was based again in 1993… simply when the non-public laptop period was simply getting began. It wasn’t till 1995, nonetheless, when it modified the panorama of the PC enterprise without end. That is when Nvidia debuted the world’s first-ever mainstream consumer-oriented graphics processing card. This tech made private computer systems rather more participating, largely by making them high-powered video gaming consoles. The remaining, as they are saying, is historical past. Leveraging its main place within the graphics card area, Nvidia has since grown from its comparatively small 1999 public providing to the $1.5 trillion powerhouse it’s at the moment. From again then to now, Nvidia inventory’s soared to the tune of 150,000%. Wow!

Granted, most buyers seemingly did not stick to the inventory that entire time. The corporate’s been by means of ups and downs which might have shaken a number of of even the staunchest of shareholders out.

Nonetheless, any shareholders capable of stick to their positions within the inventory for any significant size of time throughout the firm’s existence have completed very, very properly for themselves. Definitely a lot of them have turn out to be millionaires with some assist from Nvidia.

However, the celebration’s not over but.

Synthetic intelligence is the subsequent large development engine

Nvidia’s first couple of many years have been all about graphics processing playing cards. The following couple, nonetheless, will not be. Synthetic intelligence is its next big growth engine and can stay so for an extended whereas.

Because it seems, the identical fundamental laptop structure utilized in graphics playing cards is completely fitted to AI purposes. It would not need to deal with extremely advanced calculations. It simply must concurrently deal with mountains and mountains of digital information very quickly. Recognizing this, in 2012 Nvidia started experimenting with purpose-built AI processors utilizing its graphics card tech. The 2016 launch of its DGX-1 system marked the world’s first-ever deep-learning supercomputer, dropping the corporate proper into the guts of the then-brewing synthetic intelligence evolution. It was an excellent transfer too. AI now accounts for round three-fourths of the group’s income and is chargeable for the lion’s share of its income development.

The factitious intelligence celebration is simply getting began although. Establishments are solely simply now beginning to see the total potential of proudly owning their very own AI platforms. UIPath‘s CEO Robert Enslin lately opined that “Corporations want to consider the way to apply AI and automation to all elements of their enterprise,” for example, concluding that “All firms have to be tech firms.”

The businesses he is talking of do not appear to disagree both. Even cosmetics model L’Oreal‘s chief government Nicolas Hieronimus believes “We’re a tech firm. We’re a magnificence firm, however we’re a tech firm,” as he defined at this yr’s annual Client Electronics Present held earlier this month.

On this vein, Priority Analysis expects the AI {hardware} enterprise to develop at a yearly tempo of greater than 24% between now and 2030, reaching a worth of $250 billion within the closing yr of that stretch. The software program sliver of the factitious intelligence market — which Nvidia additionally serves — is projected to swell from round $200 billion per yr now to greater than $1 trillion in 2032, once more in response to Priority Analysis.

Already in command of the overwhelming majority of the factitious intelligence {hardware} market, Nvidia is positioned to seize its fair proportion of the market’s development.

Simply settle in for the lengthy haul

The backdrop is bullish to make certain. Nvidia’s the main title in one of many market’s hottest long-term development alternatives, in any case. Danger is low and the potential reward is excessive.

There’s one footnote so as to add to the Nvidia story although. That’s, Nvidia is a well-liked, well-watched inventory that dishes out an excessive amount of volatility. Shares additionally are typically priced at a wealthy valuation, exacerbating that volatility. And these aren’t restricted to short-term swings. Nvidia inventory can actually ebb and circulation for some time, even when issues are clearly going properly for the corporate.

Most veteran buyers perceive, nonetheless, they will want to stay plugged into mega-trends for years on finish in the event that they wish to turn out to be millionaires. This fact is not going to vary for Nvidia’s shareholders anytime quickly both.

The factor is, it is well worth the wait.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Nvidia wasn’t one among them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of January 22, 2024

James Brumley has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia and UiPath. The Motley Idiot has a disclosure policy.

1 Technology Stock That Has Created Millionaires, and Will Continue to Make More was initially printed by The Motley Idiot