After performing poorly in 2022, development shares have largely rebounded this yr, and a few have far outshone the broader market’s strong efficiency. That was the case with e-commerce large Shopify (NYSE: SHOP) and sports activities streaming specialist fuboTV (NYSE: FUBO). The previous is up by 112% yr thus far, whereas the latter has risen by 95%.

Nevertheless, these two shares are unlikely to maneuver in the identical instructions over the medium time period; the truth is, Shopify’s prospects look a lot brighter than fuboTV’s. Here is why.

The case for Shopify

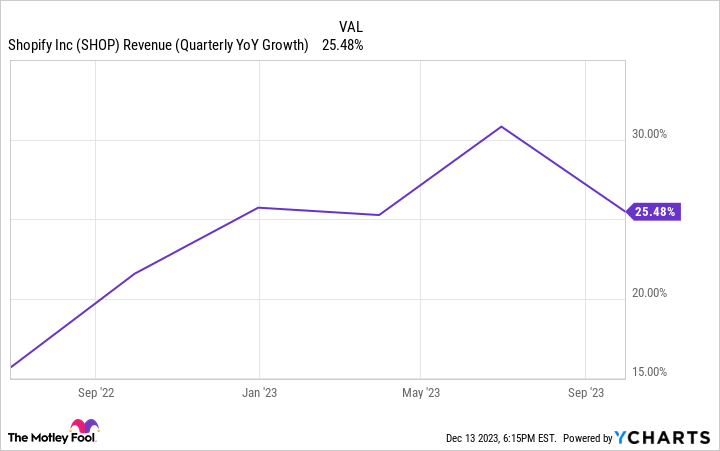

Shopify made vital modifications to its enterprise this yr. The corporate elevated the costs of its companies, which, along with a recovering economic system, helped increase its income. Within the third quarter, Shopify’s prime line grew by 25% yr over yr to $1.7 billion. That was on the excessive finish of the income development charges it has recorded prior to now yr and a half.

Nevertheless, one other change might have an much more important influence on Shopify. The corporate sold its logistics business to privately held Flexport in trade for fairness within the firm. The transfer freed up a considerable amount of money movement that Shopify will have the ability to dedicate to bettering its core e-commerce operations whereas reducing its bills and bettering its margins. Contemplating that the corporate nonetheless is not persistently worthwhile, it is unsurprising that this transfer happy buyers.

The divestiture of its logistics arm helped increase Shopify’s gross revenue by 36% yr over yr to $901 million within the third quarter, and its gross margin of 52.6% was significantly better than the prior-year interval’s 48.5%. Its outcomes might carry on bettering subsequent yr together with the economic system. Elevated client discretionary spending ought to profit the net retailers it serves and, by extension, Shopify itself. Nevertheless, it is the corporate’s long-term prospects that matter most.

On that entrance, Shopify continues to look enticing. This is not simply because it has develop into the chief in its area of interest of offering companies with all of the instruments they should create killer on-line storefronts, together with key functionalities that allow them promote their merchandise throughout varied social media platforms, amongst many different perks. One of many keys to Shopify’s future is its widening economic moat.

The corporate advantages from excessive switching prices since constructing (or rebuilding) a web based retailer from scratch takes money and time. Purchasers might migrate to one in every of Shopify’s rivals, nevertheless it’s hardly well worth the hassle. Additional, Shopify’s model has develop into intimately linked with the companies it affords. These are highly effective aggressive edges that ought to enable the e-commerce specialist to develop its shopper base and its income. There stays an enormous quantity of white area in e-commerce.

The business is projected to develop via the tip of the last decade and certain past. Shopify may benefit from that enlargement whereas delivering market-beating returns on the way in which.

The case towards fuboTV

FuboTV is one in every of many considerably notable manufacturers within the extremely aggressive streaming industry. Though it focuses a lot of its effort on protecting the marketplace for dwell sports activities, it affords loads of different content material. Its third quarterly outcomes appeared nice, a minimum of on the floor. Income elevated by virtually 43% yr over yr to $320.9 million. The corporate ended the interval with 1.477 million subscribers in North America, a rise of 20% yr over yr.

That was along with strong will increase in worldwide subscribers and common income per person. FuboTV even boosted its full-year steerage. It now expects income of between $1.319 billion and $1.324 billion, which might quantity to a rise of 34% on the midpoint. Administration had beforehand been guiding for income within the $1.260 billion to $1.280 billion vary.

That sounds nice, however here is what’s mistaken with fuboTV’s enterprise. Within the third quarter, the corporate’s subscriber and associated bills (the cash it pays to get the rights to point out the content material it does) got here in at $286.1 million, up about 33% yr over yr and virtually as excessive as its subscription income of $289.6 million (fuboTV additionally makes cash from promoting and different sources).

This single class of bills gobbles up virtually all of fuboTV’s subscription income — its largest supply of gross sales by far. And that has been the story with the corporate for some time. Consequently, fuboTV’s gross margins are razor skinny, and the corporate is deeply unprofitable on an working expense foundation. Additional, its subscription enterprise may be seasonal, as followers of particular sports activities typically cancel the service throughout their off-seasons.

As well as, it is onerous to say that fuboTV has a aggressive benefit. Loads of different streaming leaders are battling with it on the planet of sports activities, and a few have a lot deeper pockets and are higher in a position to deal with subscriber-related prices. That places it in a troublesome place. Whereas the streaming business ought to proceed flourishing by way of general viewership and streaming hours, it isn’t clear that fuboTV will ship the type of top-line development it must persistently develop into worthwhile even on an working foundation anytime quickly, regardless of the progress it made this yr.

That is why buyers ought to keep away from this growth stock.

Do you have to make investments $1,000 in Shopify proper now?

Before you purchase inventory in Shopify, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Shopify wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 7, 2023

Prosper Junior Bakiny has positions in Shopify. The Motley Idiot has positions in and recommends Shopify and fuboTV. The Motley Idiot has a disclosure policy.

1 Growth Stock to Buy Ahead of 2024, and 1 to Avoid was initially printed by The Motley Idiot