Dutch Bros (NYSE: BROS) inventory seems to have began off its life as a public firm on the incorrect foot. It sells right now at a 68% low cost to the all-time excessive it set quickly after it went public within the fall of 2021

Nonetheless, whilst buyers had been bidding down the inventory, Dutch Bros was pushing headlong into its nationwide growth plan, including espresso retailers at a fast clip and rising income. This progress, together with different components, ought to bode properly for the coffee stock over time.

The state of Dutch Bros inventory

Dutch Bros seems to have been a sufferer of the 2022 bear market. This was unlucky timing on the corporate’s half as its inventory launched close to the height of a bull market.

Nevertheless, the inventory worth conduct appears to supply the traits one may search for in a bear market inventory. After an enormous drop in 2022, Dutch Bros struggled with range-bound buying and selling because the sluggish economic system weighed on investor confidence.

Furthermore, the espresso market is very aggressive. Except for business large Starbucks, it should additionally compete with privately held chains corresponding to Dunkin’ and numerous unbiased espresso retailers. Moreover, McDonald’s has begun to construct a beverage-focused chain known as CosMc’s, and its first location within the Chicago space has proven early indicators of success.

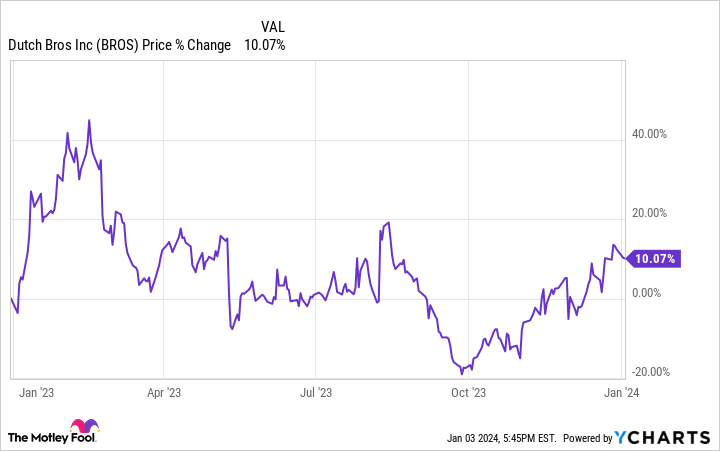

In that surroundings, Dutch Bros inventory rose by simply over 10% during the last 12 months, although at some factors in early 2023, it was up by greater than 40%.

Nonetheless, Dutch Bros carried on nearly as if it was unaffected by these challenges and continued increasing. As of the top of the third quarter, its store rely had grown to 794 because it added 153 areas over the earlier 12 months, a rise of 24%.

Dutch Bros by the numbers

The corporate’s financials present the fruits of that growth. Within the first three quarters of 2023, revenue rose 32% 12 months over 12 months to $712 million. That included a 4% enhance in same-shop gross sales.

Furthermore, it started reporting worthwhile quarters in 2022, which primarily continued into the next 12 months. Within the first 9 months of 2023, its web earnings was $14 million, in comparison with a $16 million loss within the prior-year interval.

Briefly, whilst its inventory has misplaced worth, Dutch Bros has turn out to be extra engaging — and that development ought to proceed. Administration forecasts between $950 million and $1 billion in income for 2023, which might quantity to progress of 32% on the midpoint.

Admittedly, its ahead earnings a number of is at the moment a lofty 87, however that ratio is skewed by its current shift to profitability. Its price-to-sales (P/S) ratio, nevertheless, is a extra cheap 2. That is additionally considerably cheaper than rival Starbucks, which has a P/S ratio of round 3.

Since Dutch Bros’ comparatively smaller dimension permits for increased progress on a proportion foundation, the espresso chain could current a extra compelling funding alternative than the market chief.

Contemplate Dutch Bros inventory

Dutch Bros inventory is in a strong place to revenue buyers. Whilst buyers bought the inventory, the corporate continued to push ahead with its aggressive growth plans. Additionally, its current transition to profitability and its low P/S ratio make the inventory extra engaging.

The corporate might face a extra aggressive panorama as competing espresso retailers proceed to look. However with Dutch Bros including round 150 shops each 12 months, its fast progress will doubtless take the inventory increased over time.

Do you have to make investments $1,000 in Dutch Bros proper now?

Before you purchase inventory in Dutch Bros, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Dutch Bros wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 18, 2023

Will Healy has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Starbucks. The Motley Idiot has a disclosure policy.

1 Growth Stock Down 68% to Buy Right Now was initially revealed by The Motley Idiot